What Is The Goal of Using A Personal Budget?

Everyday financial stress happens for several reasons. It may manifest from unanticipated expenses or unmanaged compulsions to purchase unneeded items (without the financial means).

Financial stress may be caused by external influences like inflationary economic conditions eating away the dollar’s buying power, along with many other factors.

Trying to manage financial anxiety without an effective coping strategy likely leads to more stress and, often, even more spending.

Fortunately, there is a simple, proven solution to this age-old financial dilemma – the budget, a tool that can be created using a pencil & paper, a spreadsheet, or an app specifically designed for budgeting.

What is the Goal of Using a Personal Budget?

The primary intention of a personal budget is to find the most direct way to optimize one’s financial position or overall wealth.

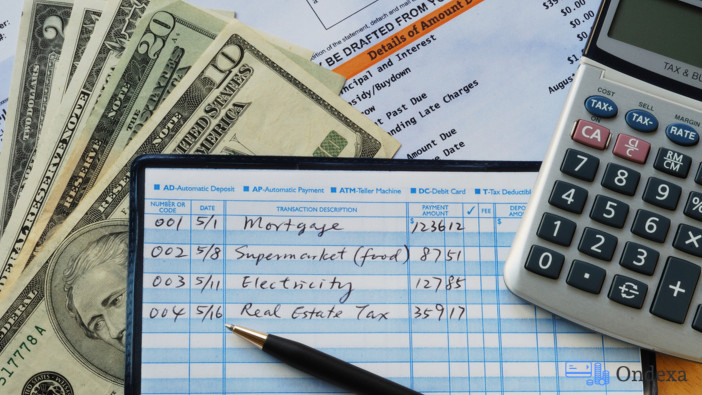

In other words, a budget is a financial device that allows you to organize income and expenses. It provides the opportunity to identify hidden spending patterns that, when improved, will create a stronger financial position today and in the future.

A budget, as a financial strategy, is a great way to learn how to manage your income more efficiently so you can –

- Make timely payments and enjoy the perks of maintaining a good to excellent credit score

- Create an emergency fund to be prepared for life’s unexpected events and,

- Consistently save to meet future financial objectives.

What Are The Benefits of Using a Personal Budget?

A Budget Provides Real-Time Knowledge & Feedback

Budgeting is an ongoing bookkeeping task. It is a smart financial tool that helps define one’s current and future objectives while providing the structure needed to reach these goals.

A budget is only effective if designed with realistic objectives because it can map out a timeline that allows for –

- Saving money for a new car, a down payment for a home, or any other financial goal.

- Keeping track of your financial progress, allowing for adjustments when needed.

A budget is beneficial when you need help deciding that it is more important to delay gratification (i.e., save for a new home) than to satisfy an immediate (often fleeting) need for a new video game or leather jacket, etc.

A Budget Puts You In Control Of Your Finances

One of the primary goals of employing the use of a budget is that it has excellent potential to create financial stability in one’s life.

Using a budget helps you avoid drifting aimlessly, throwing hard-earned money at shiny objects that seem appealing, at least for the moment.

Gather your bills and organize them into general categories. This simple exercise will offer greater insight into your income and spending habits by itself.

A budget must include clearly defined financial goals. Consider where you would like to be in one year, five years, and even ten years. Which purchases are included in your savings goals?

With this newly obtained insight into your finances, you can now begin to see how you manage money while identifying opportunities to revise the budget to reach your desired financial results.

A Budget Helps Ensure You Don’t Spend Money You Don’t Have

The reality is that many consumers choose to spend money they simply don’t have by charging their purchases and paying over time, with compounding interest.

According to data provided by Experian, in 2021, the average credit card debt in a U.S. household was $5,221, and the average auto loan for the same time was $20,987.

The ease created by the age of plastic has made it nearly effortless to overspend, and often, those new to the use of credit don’t recognize their overspending until they find they are drowning in debt.

What are the Downsides of Having a Personal Budget?

Budgeting Requires That You are Honest with Yourself.

The adult decision to budget your income and establish an emergency fund is also a time when you must face some hard truths about your current spending habits. If stress caused by financial issues impacts you, it is usually because –

- Your spending exceeds your income.

- There are external financial pressures on your financial world (medical bills, family members in need of help, etc.), to name a few.

Budgeting Requires Discipline

Budgeting requires discipline, which can be challenging and, for some, even unfamiliar territory to traverse. But once you have mastered this skill, budgeting is no longer scary but a true source of empowerment.

While it may sting to have to pass on some of the more expensive and luxurious entertainment choices, your diligence does have its rewards.

When your credit-card-crazy friends are meeting with a debt adviser sometime in the future, you will be either on vacation or closer to your new home’s down payment.

Managing a Budget Requires Time & Dedication

Personal budgeting also requires time, which is often a short commodity in the modern world. But budgeting is not as complex or laborious as it may appear, although it does require dedication.

While it begins with a plan and a list of all current obligations and bills, it must be used regularly to determine if you have met your defined goals each month.

If the income and expense numbers do not jive, it may mean you need to modify the budget.

And remember, life changes over time, but once you have established a well-thought-out baseline budget, making minor tweaks is simple.

Pro-Tip – Prior to making a large purchase, consult with your current budget and your savings account balances.

What Are The Best Ways To Keep A Personal Budget?

Budgeting provides a clear vision of your financial picture, allowing you to control how your income is spent and saved.

One of the secrets to simple budgeting is not overcomplicating your budget’s expense categories. For example, one grocery category will suffice, rather than separating the expenses for each supermarket you shop at monthly.

Budgeting methods are designed to help you understand and assess your relationship with money. These are the more common types of budget plans, although there are others. Select the budgeting technique that best fits your goals, objectives, and lifestyle.

- The 50/30/20 Budget – this divides your income, 50% dedicated towards necessities, 30% to objectives, and 20% towards debt repayment and savings.

- The Zero-based Budget System – is a method where the budgeter allocates every dollar earned to either savings, debt, or expenses.

- The Envelope System –allows the budgeter to portion monthly income to defined categories, and this can be done with cash or digitally.